Q: Why are you writing this blog? What’s the point of this website?

A: I’ve learned a lot from other travel-related blogs, but many of them are too willing to sacrifice quality of content for the sake of shilling credit cards. My goal with this website is to help others travel and to save money without turning every article into some sort of advertisement.

Q: So does that mean you won’t make any money from this website?

A: I doubt I will ever qualify for credit card affiliate links, so that much is basically out of the question. At the moment, I have one referral link for the Chase Ink card. Shopping portal links will typically all be referrals since they are free anyway, and I can’t think of a good reason not to use them. Having said that, no, I don’t expect this website to be much in terms of a source of income. I certainly won’t be quitting my day job.

Table of Contents

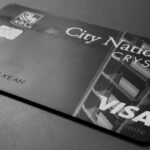

Credit Cards

Q: Doesn’t signing up for all of these credit cards hurt your credit score?

A: No, not in the long run at least. When you apply for a credit card, your score does take a temporary hit, often about 5 points per application, but this only lasts a few months. Long term, having all of these open accounts can even help, though that’s beyond the scope of the discussion here. At the time of this post, my FICO score is 815, and I have 31 open credit cards.

Q: So I should sign up for lots of credit cards then?

A: Yes, but only if you can pay off all of your balances in full every month. I don’t want my advice to lead to people having credit card debt and interest payments, so make sure you can stick with your budget regardless of how many cards you have. Also, if you’re planning on taking out a mortgage within the next 2 years, you can still apply for credit cards, but I would limit myself to one card every 6 to 12 months.

Q: Which credit card should I get?

A: It depends. For most beginners, I recommend the Chase Sapphire Preferred Card, but I also go through a more in-depth discussion at Which Credit Card Should I Get?

Q: Can I really get a business card?

A: You probably can. Think about whether there is anything you do for a profit. Aside from what we traditionally think of when we heard the word “business,” what about selling things on ebay or craigslist? Or any hobby where you can sell the fruits of your labor? Don’t be embarrassed if whatever it is doesn’t have you rolling in dough. My only advice is to tell the truth. I’ve applied for credit cards using this blog as my business – they ask how long I’ve been in business and how much revenue I have, and my answers are less than 1 year and $0, respectively. I still get approved. Some credit cards are more selective about your answers, but many will still approve you even if you don’t think your stats are that impressive.

Airline Miles

Q: Where’s Delta?

A: I have a strong dislike for Delta and the way they manage their frequent flyer program. They devalue their miles consistently, and they refuse to even publish an award chart. Anyway, if you’re not discouraged by this, just about every other points & miles blog covers them in some fashion. I won’t be discussing them here.

Juliana, the author of MilesBriefs.com, is a Personal Finance Writer and Travel Rewards Expert with over 5 years of experience in the finance industry. Holding a Master’s degree in Finance, she provides in-depth insights on credit card offers, rewards programs, and financial tips to maximize travel savings. Connect with Juliana on Instagram @strategicmiles for the latest updates and tips on achieving financial and travel rewards success.

generic phenergan – ciprofloxacin 500mg price purchase lincocin generic